Pet Insurance for the Unexpected

Unlimited reimbursement

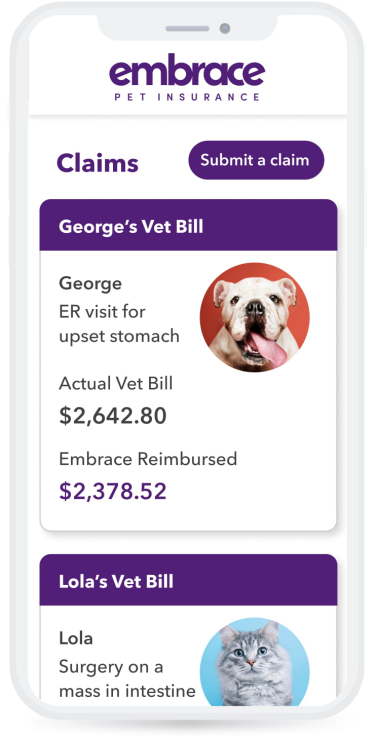

Claims made easy

Use at any vet

or Call (800) 779-1539

Rated 5-star pet insurance by Forbes

We know what pet parents need in a pet insurance policy, which is why we offer:

10% Multi-pet discount

Exam fee coverage

Free 24/7 pet helpline

How Embrace pet insurance works

Visit any vet

With no network restrictions, you can choose from any veterinarian, including emergency and specialist vet clinics.

Submit a claim online

Take a picture of your invoice and submit using the Embrace website or app. No claim form or paperwork needed.

Get money back fast

Use direct deposit and get paid right to your account when your claim is approved.

Embrace leads the pack

We offer one simple and customizable pet health care plan, letting you choose the price and coverage you need. Compare coverage options and benefits of the other pet insurance providers below to see the difference.

| Plan features | Healthy Paws | Nationwide WholePet® | Pets Best | Trupanion | |

|---|---|---|---|---|---|

| Flexible wellness plan | Per-item Limits | ||||

| Dental illness coverage | |||||

| Options for coverage of exam fees | |||||

| Extra office visits for senior pets | |||||

| Hip dysplasia coverage on all Accident & Illness policies |